INTEREST RATES AND INVESTMENT DEMAND

INTEREST RATES AND INVESTMENT DEMAND

Investment is money spent or expenditures on...:

- new plants (factories)

- capital equipment (machinery)

- technology (hardware and software)

- new homes

- inventories (goods sold by producers)

Businesses make investment decisions using cost/benefit analysis. Businesses figure out these benefits using expected rates of return. They count the costs using interest costs. Businesses determine the amount of investment they should undertake by comparing the expected rate of return to the interest cost. If the expected return is greater than the interest cost, then they should invest. If the expected rate of return is less than the interest cost, then they shouldn't invest.

The nominal interest rate (i%) is the observable rate of interest.

Real interest rate (r%) subtracts out the inflation rate (π%) and is only known ex post facto. The real interest rate determines the cost of an investment decision.

The equation is...:

r% = i% - π%

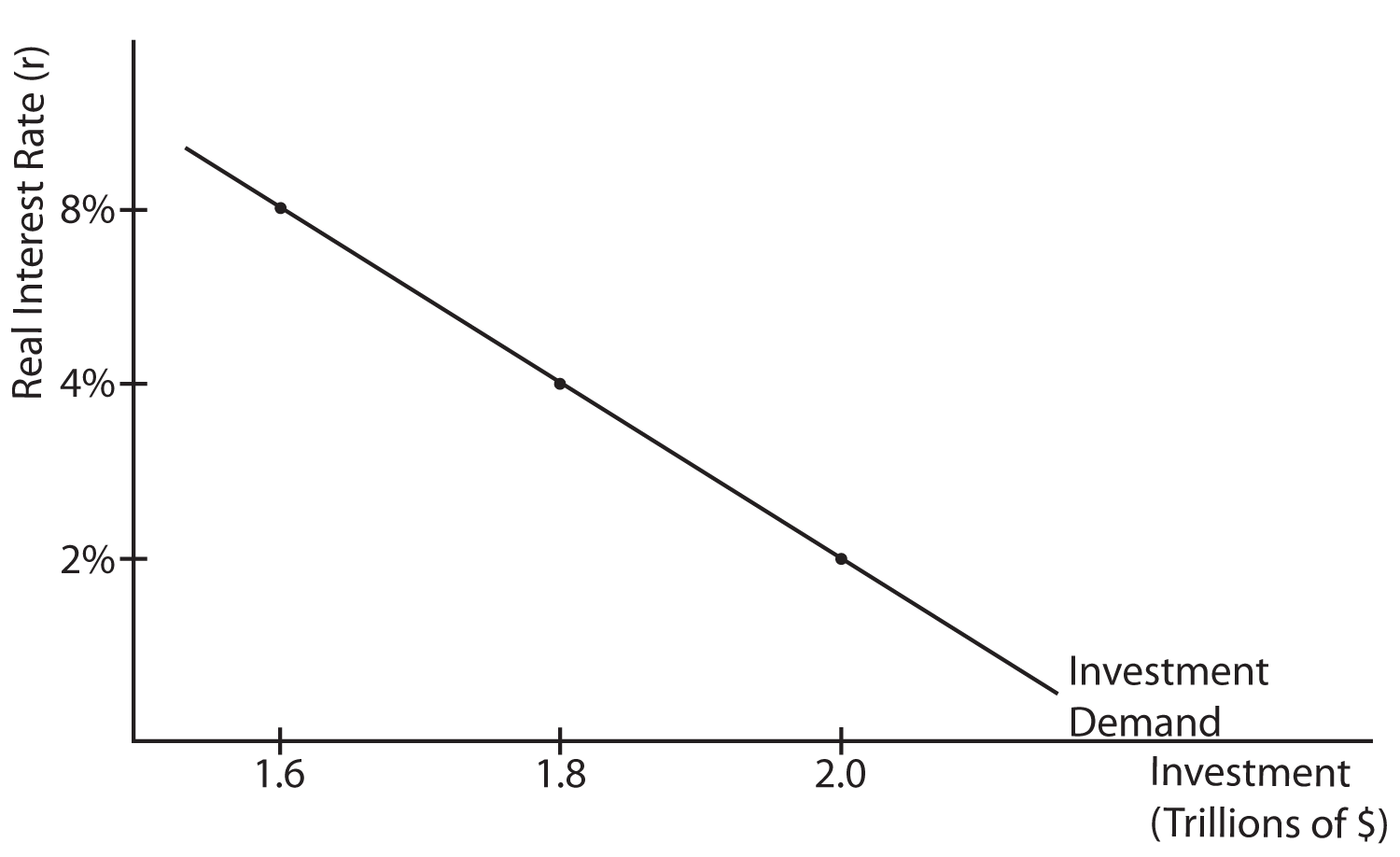

The shape of the investment demand (ID) curve is downward sloping because when interest rates are high, fewer investments are profitable; when interest rates are low, more investments are profitable. There are few investments that yield high rates of return and many that give low rates of return.

If you're still confused, here are some vids 2 help :) :

Real and nominal return:https://www.youtube.com/watch?v=p6lkDjq8-tw

Calculating real return in last year dollars: https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/ap-financial-sector/nominal-v-real-interest-rates-ap/v/calculating-real-return-in-last-year-dollars?modal=1

Nominal interest, real interest, and inflation calculations: https://www.khanacademy.org/economics-finance-domain/ap-macroeconomics/ap-financial-sector/nominal-v-real-interest-rates-ap/v/nominal-interest-real-interest-and-inflation-calculations-ap-macroeconomics-khan-academy2?modal=1

Comments

Post a Comment